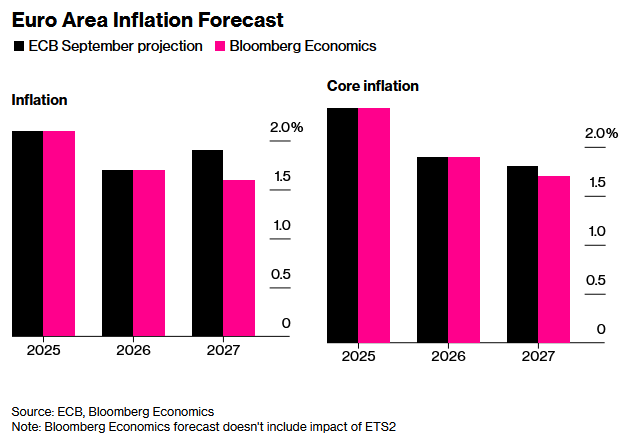

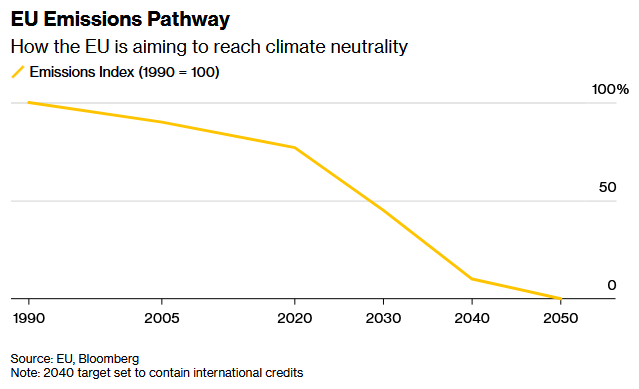

The EU's delay in implementing a new carbon pricing system is expected to put pressure on the inflation outlook and may reignite market calls for further interest rate cuts. It is reported that in order to help alleviate the impact of the EU's green transformation, EU governments and legislators hope to postpone the launch of Emissions Trading System 2 (ETS2), which will impose costs on polluting emitters and may lead to price increases for fuel and other commodities. This measure means that the increase in consumer prices (CPI) in the Eurozone in 2027 may be lower than the current forecast, and will expose the European Central Bank to a situation where inflation in 2026 and 2027 is below the 2% target level.

Although European Central Bank officials generally believe that current challenges, including global trade weakness and fiscal pressures in some eurozone countries, are not enough to force the central bank to adjust interest rates, the delayed implementation of ETS2 may prompt some to call for a return to loose monetary policy.

Danske Bank economist Rune Johansen said, "All other things being equal, if ETS2 fails to take effect in 2027, the extent of inflation being lower by then may be even greater. ”This will become one of the reasons to support further interest rate cuts, although some officials will still express opposition

The latest quarterly forecast from the European Central Bank predicts inflation rates of 1.7% and 1.9% respectively for the next two years. Some studies suggest that the implementation of ETS2 will drive up inflation by 0.2 percentage points or more in 2027. Economists David Powell and Simona Delle Chiaie said, 'Without the boost brought by ETS2, inflation forecasts may be closer to our own estimates.'. Due to the uncertainty of the impact of ETS2 on inflation and the implementation of various countries, the forecast of European Central Bank staff may be optimistic. ”

Before the European Central Bank released its next round of forecasts, other institutions also came to similar conclusions. Morgan Stanley economist Greg Fuzesi pointed out, "The impact that was originally concentrated in 2027 may now be removed from the December forecast and replaced by a smaller impact in 2028.

Mobile phone:+86-0516-87631319

Phone:+86-15651461419

Mailbox:3966142672@qq.com

Address: No. 20 Zhenxing Avenue, Xuzhou Economic and Technological Development Zone, Jiangsu Province